This allowance is not intended to offset the costs of meals for family members.īeginning on January 1, 2002, all enlisted members received full BAS, but paid for their meals (including those provided by the government). This allowance is based in the historic origins of the military in which the military provided room and board (or rations) as part of a member's pay. Basic allowance for subsistence (BAS): BAS is meant to offset costs for a member's meals.įor members of the Army Reserve and National Guard performing duties with their units on battle assembly weekends, pay is usually based on four drill sessions of four hours per session, equal in pay to four days of active duty pay.

#ENLISTED PAY SCALE CODE#

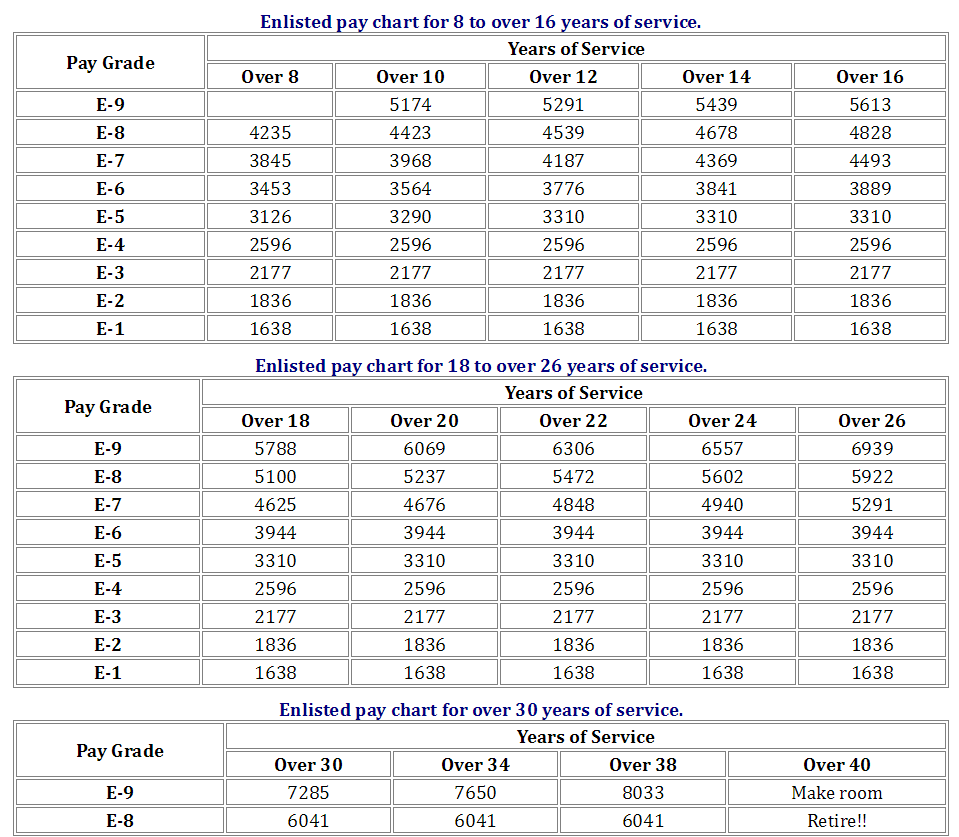

Reserve/National Guard "drill" pay Īccording to Title 37 United States Code §206, the basic pay amount for a single drill is equal to 1/30 of the basic pay for active duty servicemembers. In addition to across-the-board pay raises for all military personnel, mid-year, targeted pay raises (targeted at specific grades and longevity) have also been authorized over the past several years. The 2007 pay raise was equal to the ECI.Ī military pay raise larger than the permanent formula is not uncommon.

#ENLISTED PAY SCALE PLUS#

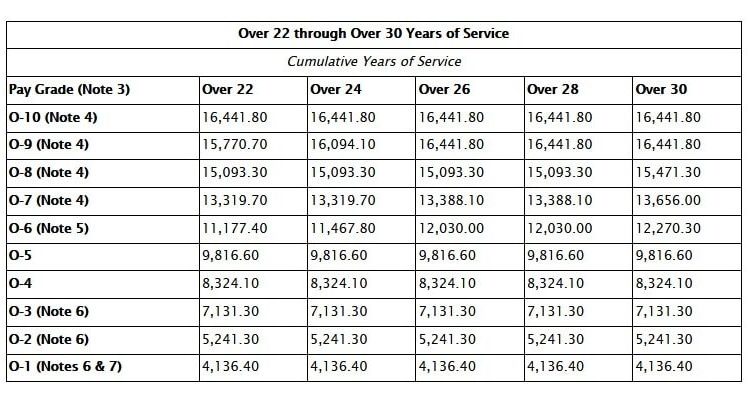

However, Congress, in financial years 2004, 2005, 2006, 2008, and 2009 approved the pay raise as the ECI increase plus 0.5%. The fiscal year 2010 president's budget request for a 2.9% military pay raise was consistent with this formula. 1009 provides a permanent formula for an automatic annual military pay raise that indexes the raise to the annual increase in the Employment Cost Index (ECI). Basic pay is the same for all the services. There are a few components which most military members receive.Īlso known as "base pay", this is given to members of the active duty military on a monthly basis and is determined by their rank (or more appropriately their pay grade) and their length of time in military service. (End of month pay used to fall on the last day of the month, but in 1990 was moved one day to the first to save money in a fiscal year.) The payment on the 15th is known as "mid month pay", and the pay on the 1st is "end of month pay". The money is directly deposited into a member's personal banking account. The monthly pay statement is known as a " Leave and Earnings Statement" (LES), which is usually available near the end of each month. If the 1st or 15th of the month falls on a Saturday, Sunday, or federal holiday the member is paid the first business day before. Typically members are paid on the 1st and 15th day of each month. Since it was determined that allowances are not income, they cannot be taxed, divided, or garnished, while pay can be. The United States, the United States Court of Claims decided that military allowances are not "of a compensatory character" and "not income as well". Generally speaking, pay is income, while allowance is reimbursement.

Typically, pay is money which is based upon remuneration for employment, while allowance is money necessary for the efficient performance of duty. There are two broad categories of military pay: "pay" and "allowance".

0 kommentar(er)

0 kommentar(er)